The COVID-19 health crisis has impacted the vast majority of the Group's activities in all regions of the world since the beginning of 2020. The first effects were felt in China in January, forcing the Group to close its commercial and industrial activities in this country, then from March in Europe and April in North and Latin America.

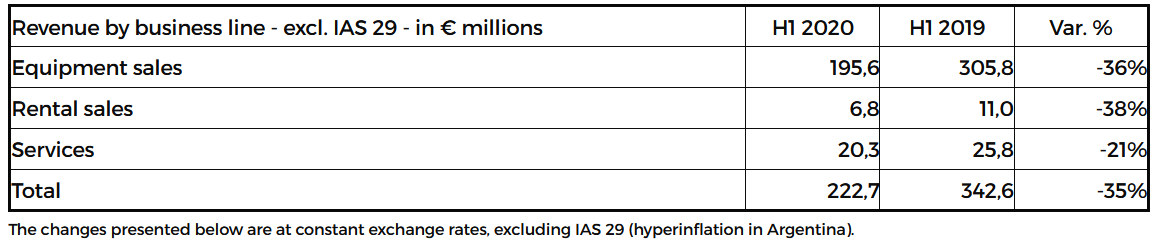

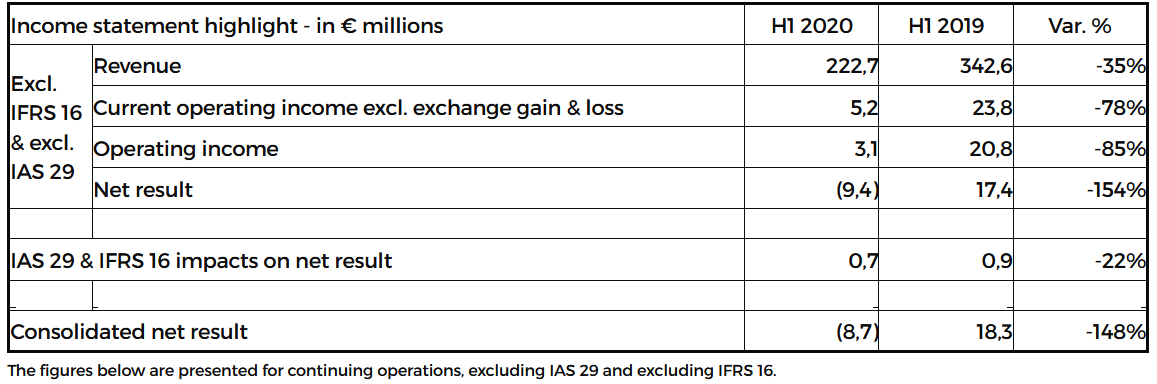

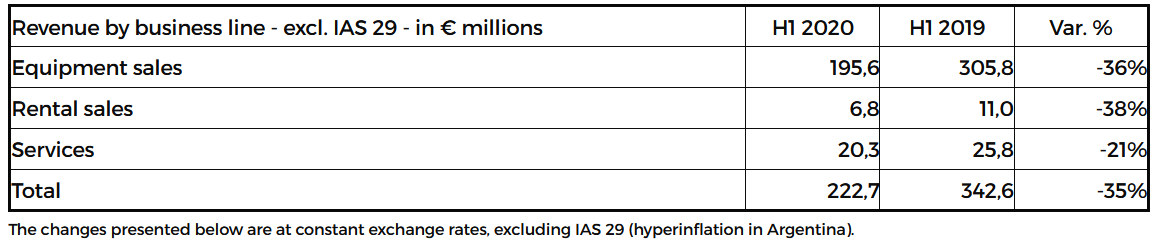

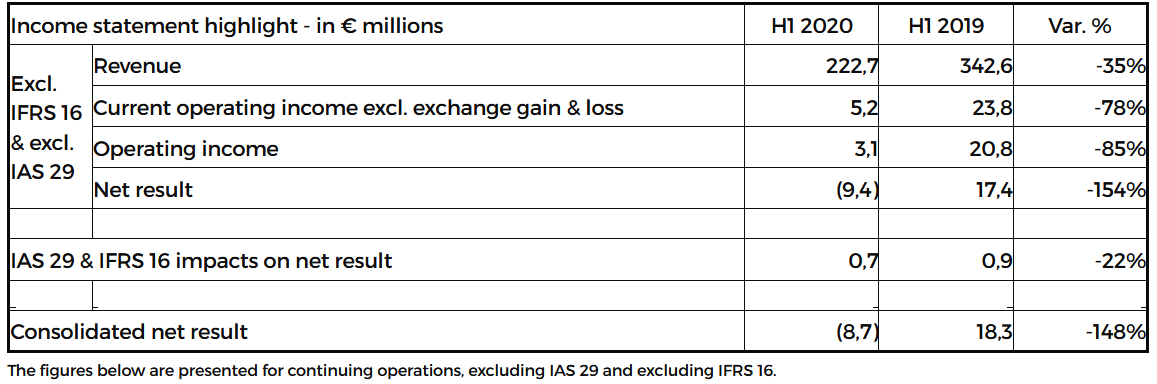

Against this unprecedented backdrop, Haulotte posted half-year sales of € 222.7 million, down -35% compared to the first half of 2019 (a record half-year in the Group's history), representing a -50% drop in business over the second quarter compared to 2019.

Group half-year sales in Europe were down -39% year-on-year, with almost all markets posting a very sharp decline in the second quarter. In Asia-Pacific, half-year sales declined by -23%, despite a sharp rebound in sales in the Chinese market during the second quarter, China being the only significant market in the world to grow over the semester.

Despite a sharp decline in the North American market, Group half-year sales held up well, particularly in the aerial work platforms business, and declined by -28% over the period.

As for Latin America, already strongly affected by a difficult economic and political context, the arrival of Covid-19 only aggravated the situation in all markets, resulting in a -47% drop in activity over the semester.

Equipment sales were down -36% over the period, the services business held up well and posted a -21% decline, while the rental business ended the period at -39%, strongly impacted by the health situation in Latin America.

First half results: