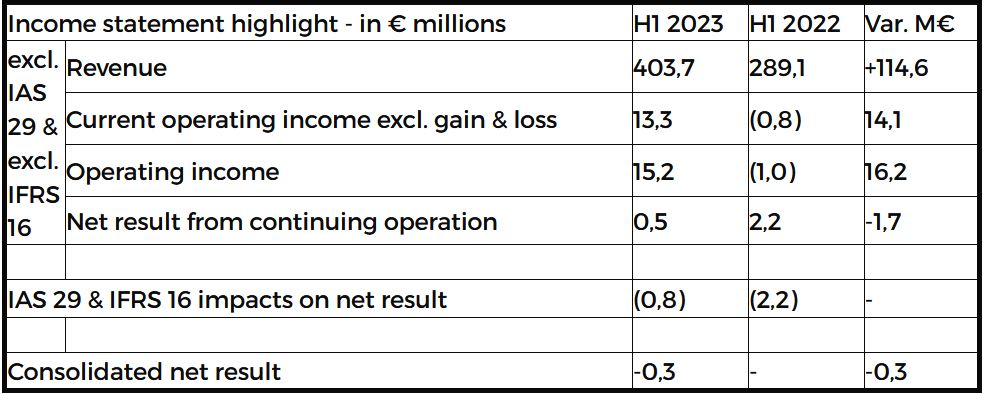

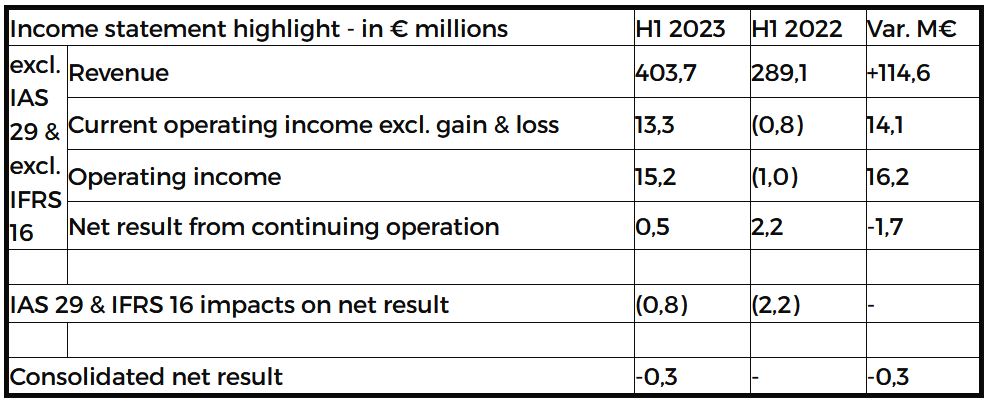

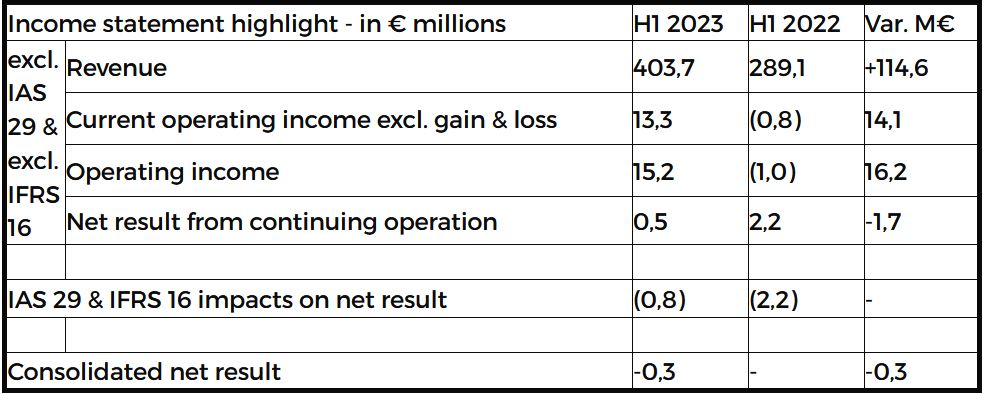

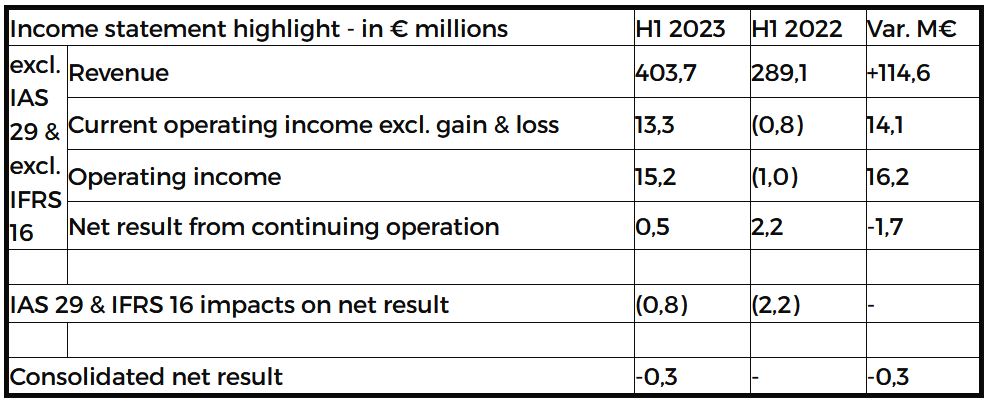

The changes and figures presented below are excluding IAS 29 (hyperinflation in Argentina and Turkey) and IFRS 16 (leases)

Current operating income (excluding foreign exchange gains and losses) was + €13.3 million, or +3.3% of sales, driven by strong volume growth and the first positive effects of sales price increases, in a context of slowing production cost increase.

The Group’s net income amounting to + €0.5 million, or +0.1% of revenue, was negatively impacted by unrealized foreign exchange losses (-€8 million) as the currency environment was less favorable for the Group over the first half of the year.

Group net debt (excluding guarantees and IFRS16) amounted to €261.1 million at 30 June 2023, up + €15.1 million over the period, was impacted by the increase in working capital requirements (+ €23.6 million) linked to the strong growth in activity despite the return to profitability and the reduction in inventories observed over the period.

As a reminder, a request for a waiver regarding the respect of the ratios for the period of June 2023 was submitted to all lenders and accepted unanimously and without condition, on May 23, 2023. In addition, in April 2023, the Group had chosen to amortize the repayment of its State Guaranteed Loan over 5 years.

Outlook and recent events:

Driven by a still dynamic market, and a backlog that remains well above normal, Haulotte expects annual revenue growth from +25% to +30% in 2023 and a current operating margin from +3% to +4% of net sales (excluding foreign exchange gains and losses).

Upcoming event

Quarter 3 Sales : October 24th, 2023

Annual Sales : February 13th, 2023